Commercial Plastics buys custom injection molding manufacturer in Monterrey, Mexico

We are pleased to inform you of some exciting news! Commercial Plastics has acquired the assets of Epkamex, S.A. de C.V., a custom injection molding manufacturer in Monterrey, Mexico. The name of our new location is Commercial Plastics Monterrey LLC.

Epkamex, S.A. de C.V. shares the same core values as Commercial Plastics and now bringing the two together only strengthens our ability to service our customers. We look forward to growing our capabilities and continuing to build upon the fantastic partnerships already in place.

Epkamex Highlights:

• 180,000sqft facility with a 45-foot ceiling height

-

30 molding machines with current plans for up to 3,000 ton machines

-

ISO 9001 certified, IATF 16949:2016 certified, IMMEX

-

Family owned with 75 employees

With the acquisition of the assets of Epkamex, S.A. de C.V., we will have five manufacturing sites located in Wisconsin, Nebraska, Illinois, Minnesota and now Monterrey, Mexico. We currently have 700 employees who service the following industries: Medical & Healthcare, Agriculture, Hygiene Products, Outdoor Recreational, Lighting, Commercial Furniture, Appliance, Automotive, Consumer Products, Electrical, Power Sports, HVAC, and Health & Fitness.

Commercial Plastics has always been committed to being your full-service custom molding partner. That means making a commitment to go beyond injection molding to work with our customers as partners to enhance their productivity and profitability.

If you would like to learn more about our company, we encourage you to check out our website at www.ecommercialplastics.com.

Illinois-based Commercial Plastics buys Minnesota injection molder

Terms were not disclosed. Imperial Plastics is a diverse thermoplastic molder with insert, gas-assisted and structural foam molding technologies. It has a 400,000-square-foot plant in Mora, Minn., and a leased headquarters plant in Lakeville.

Imperial Plastics was founded in 1968 and serves the agricultural, building materials, outdoor recreation and industrials end markets. It had a third plant in Mankato, Minn., which it opened in 2014 but closed in early 2017 after it lost contracts from one of its major customers who moved production outside the United States.

Imperial had also grown through acquisition. The Lakeville-based company bought Mora-based Engineered Polymers Corp. in 2014.

Imperial was No. 86 in Plastics News‘ 2019 ranking of North American injection molders, with estimated sales of $85 million. Commercial Plastics ranked No. 90, with estimated sales of $80 million.

Chicago-based Stout advised Imperial Plastics on the sale.

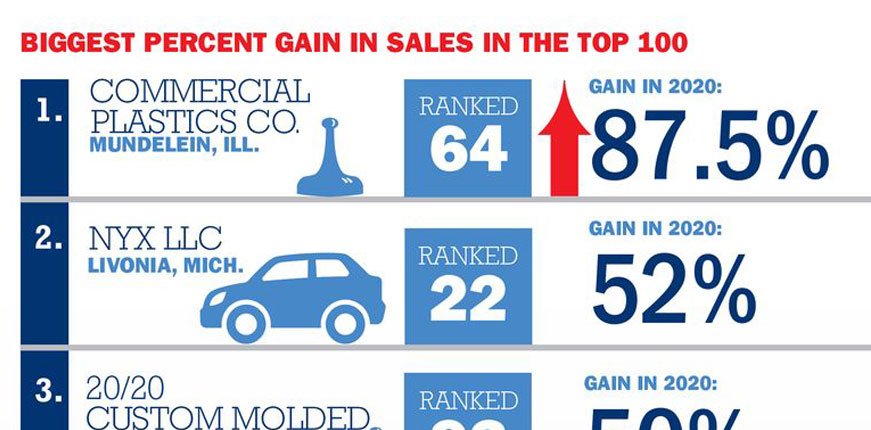

A six-way tie in ranking for injection molders

This group represents combined related sales of $29.3 billion. While that number is above last year by a tiny fraction of 1 percent, the average sales per firm is down 0.8 percent. Why? Mostly due to declines in the automotive market in 2019.

Those companies were hit again with shutdowns due to the pandemic — which aren’t reflected in 2019 numbers — so it’s a tough market, no doubt.

Resin prices dropped a bit among the top materials. ABS, nylon, polycarbonate and polyethylene saw smaller declines of 2-9 percent, however, polypropylene showed the biggest slide at 19.2 percent.

Let’s get back to that pandemic thing, A very non-scientific look at our story listings has 236 mentions of COVID-19 in the eight weeks between the end of February and mid-June. I can’t tell if the disruptions helped or hurt our research.

On one hand, we heard from some companies that had not responded in the past. But at other firms, some communication departments were out of sync with our regular avenues to update information.

Very few of our telephone calls to company headquarters were successful, and our best responses came from email and cell phones.

This leads me into another of my public service announcements, this time to website editors: Please double check the contact email listed online, nothing is worse than generic mailboxes like info@ or customerservice@ bouncing back as undeliverable. If you weren’t contacted for this ranking or any type of recent special coverage, please let us know how best to reach you.

And finally, congratulations to Tessy Plastics Corp. for breaking into the top 25 this year.

Want more information? Visit our top 100 ranking online at http://www.plasticsnews.com/rankings/injection-molders. And watch next week’s issue for the rest of this year’s injection molders’ ranking.

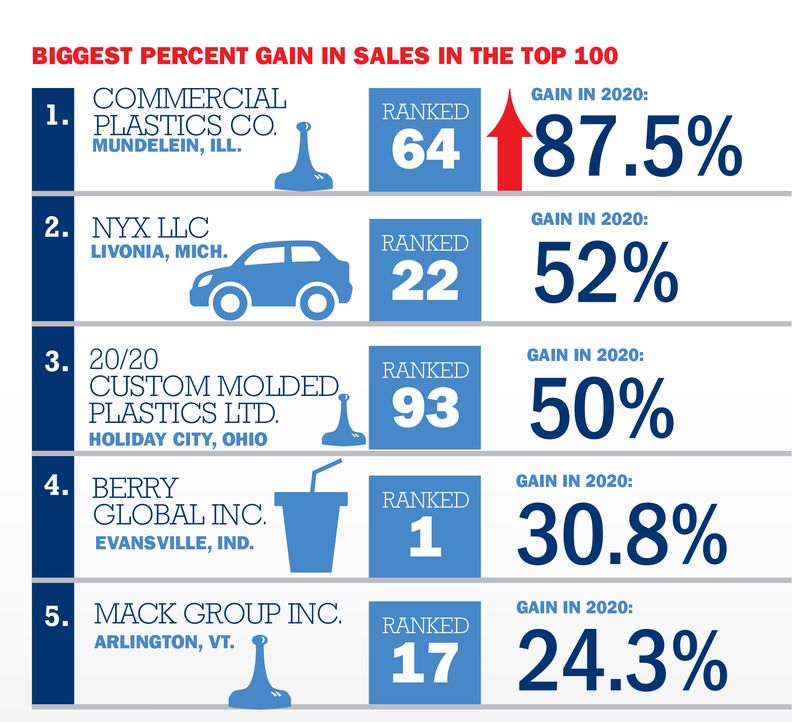

Commercial Plastics Company / Inc. 5000

A plastic injection molding company with core competencies in design assistance, assembly, decoration and logistics. As a qualified supplier, it can also source non-plastics components, manufacture finished assemblies and products, perform quality assurance and ship the finished products to the end user.

Commercial Plastics purchases latest IML automation

Working with CBW Automation, CO and Robotic Automation Systems, WI, Commercial Plastics expanded its technology reach with the latest in IML automation with 2 CBW pre-cut roll fed systems, 1 six-axis Fanuc robot, and 2 three-axis Hahn robots.

The goal of the new technology was to improve the performance of the customer’s product, improve sequential barcode processes, reduce set up scrap rates, expand label technology, improve MDR processes and improve production flexibility. One challenge was the sequential barcodes on each label set that demanded stringent quality control. We now read the barcodes upstream in the process, which eliminates out of sequence barcodes in the molding process. All of these goals were achieve above our expectations and we now have other customers asking to use this technology.

Commercial Plastics Expands Its Focus On LEAN Manufacturing

Commercial Plastics is working to further expand its focus on manufacturing cost control and productivity enhancement through the creation of a dedicated LEAN training program in its Kenosha, WI facility.

The program will be implemented and supervised through the newly created position of LEAN Manufacturing Engineer. The inaugural incumbent is Shriraj Parikh, who is also new to CPC, being hired in from his former position as Lead Lean Engineer for Bimba Manufacturing, Monee, IL.

Parikh joins Commercial Plastics after a 9-year career working in Continuous Improvement and Lean positions for companies in such technical businesses as industrial automation (Bimba Manufacturing), motion and control technologies (Parker Hannifin) and Mechanical and Industrial Engineering (Flowserve Corporation). He holds an MS in Industrial Engineering and BS in Mechanical Engineering.

“My immediate objective is to install an effective training program across all plant disciplines, with particular emphasis on CPC’s cell manufacturing system,” said Parikh.

Dudefest is here! A Benefit Concert for Misericordia

Dudefest is an event that is near and dear to the Commercial Plastics heart …

Aug. 13th marks the 6th Annual Dudefest, a benefit concert for Misericordia. The primary goal of the night is to support the programs that enrich the lives of the more than five hundred and fifty children and adults who call Misericordia home. All proceeds from the event will go directly to Misericordia. (http://www.misericordia.com/)

Your support for Misericordia by participating as a Corporate Sponsor is greatly appreciated. The deadline for sponsorship is Friday, August 5th.

Bill O’Connor, President of Commercial Plastics, has been on the event committee since 2012, and the O’Connor family has been supporting Misericordia for over 50 years.

Please let us know if you need any additional information. If you would like to be a sponsor, please contact Commercial Plastics at [email protected]. Why Dudefest? Our dear friend, cousin, sister, aunt, Bree Creevy, nickname The Dude, lives at Misericordia and the main reason behind Dudefest along with all her friends and family at Misericordia.

Questions about the event? Please contact the Dudefest event committee at [email protected]. Thank you for your support – and hope to see you at Dudefest!

Commercial Plastics buys molder Lenco-PMC

Commercial Plastics Co. has purchased certain assets of Lenco Inc.- PMC , according to the financial advisor for PMC Group Inc., the parent of Lenco.

Stout Risius Ross of Chicago served as the exclusive financial advisor to PMC Group. Terms of the transaction were not announced.

Commercial Plastics officials did not respond to requests for comment.

Lenco is a molder in Waverly, Neb., specializing in high volume injection molding, assembly and secondary finishing. According to its website, it has a tool room and 60 injection molding machines. It also CD and DVD packaging and a wide range of bar and food service plastic items.

Commercial Plastics is based in Mundelein, Ill. It expanded in November, 2014, with the acquisition of assets from injection molder Xten Industries LLC, in Kenosha, Wis. That operation is now known as Commercial Plastics Kenosha LLC.

Commercial Plastics buys Xten Industries

Mundelein, Ill.-based Commercial Plastics Co. has purchased the assets of Xten Industries LLC, a Kenosha, Wis.-based custom injection molder.

The deal combines two companies with a similar focus: molders that specialize in large-tonnage machines to make aesthetic parts from engineering resins, according to Bill O’Connor, a co-owner of CPC and the company’s vice president of sales.

Both companies also specialize in using automation and performing secondary operations, he said.

“The core values are the same between Xten and Commercial Plastics. That trickles down to the employees as well. We thought they’d make a good fit,” O’Connor said in a phone interview.

The Xten Industries plant in Kenosha will continue business as normal, but the operation will be known as Commercial Plastics Kenosha LLC. All current Xten Industries workers will stay on, including co-founders Bill Renick and Matthew Davidson.

Terms of the deal were not disclosed. Xten employees were told about the purchase on Nov. 12, and the company announced it on Nov. 14.

Pat LaCross, who is working on integrating the two companies, said Commercial Plastics owners Matthew and Bill O’Connor see this as a good time to expand their custom injection molding business.

“They saw a great opportunity to come in and right the ship and get things back on track in Kenosha,” LaCross said in a telephone interview.

LaCross said Commercial Plastics and Xten were similar-sized companies, both with about 140 employees. Xten has annual sales of about $25 million. O’Connor said the combined companies will have 2014 sales of between $60 million and $65 million.

The deal does not include an Xten plant in Lockport, Ill., which recently closed. O’Connor said the news of the deal was very well received in Kenosha.

“I think [there was] a big cheer,” O’Connor said. “They saw what happened in Lockport and got nervous.”

He declined to comment on Xten’s financial situation. O’Connor said the owners of Xten had been considering a potential sale for some time, and recent events accelerated their timetable.

The purchase was not a surprise. Xten officials had filed a Worker Adjustment and Retraining Notice (WARN) with Wisconsin officials on Oct. 22 saying that they intended to sell the company’s assets to CPC. But at the time they noted that if a deal fell through, Xten might close.

O’Connor said by the time the Xten filed the WARN letter, the deal was nearly finished. In the WARN letter, Xten said CPC was a stalking horse bidder for Xten’s assets. But, in the end, the two companies agreed to a deal, and there was no auction, O’Connor said.

CPC President Matthew O’Connor said in a news release: “We see growth opportunity with the quality partnerships Xten has built over the years and look forward to further developing those relationships.”

Xten Industries began as Hauser PlasTech Inc. in Chicago in the 1940s. The company changed its name to Xten in 2000, and in 2002 it moved into a custom-built 78,000-square-foot factory in Kenosha. The company has 31 presses ranging from 60-1,140 tons of clamping force, and has customers markets including consumer goods, medical waste and food industries.

O’Connor said Commercial Plastics has made five acquisitions in the past 10 years. All were small asset purchases — “one-tenth the size of this, easily absorbed,” he said.

The company didn’t publicize some of the previous acquisitions, and O’Connor noted: “We kind of like to fly under the radar a little bit the last few years.”

But this deal is different, since Xten has a higher profile, and because CPC is keeping the Kenosha plant open.

O’Connor said Kenosha may even see growth in the future. The Xten facility was designed to expand, with room to double the square footage. O’Connor CPC may choose to expand its molding capacity in Mundelein, and add more warehousing in Kenosha.

“We’re looking to grow in either location. I think this purchase gives us that opportunity potentially in the Kenosha area,” he said.

Xten’s Bill Renick called the purchase “a smart play by CPC” in the news release.

“We have worked together for years on various projects and discovered along the way our compatibilities and synergies,” Renick, “I am excited about the future.”

Xten’s Matthew Davidson added: “We are also proud that Commercial recognized the great team we have here. It is encouraging to know that our employees will continue as part of a growing company and as part of the fantastic community of Kenosha.”

Commercial Plastics has 33 presses in its 105,000-square-foot plant in Mundelein, ranging from 65-2,000 tons of clamping force. Its markets include lighting, recreational and outdoor consumer products.